- All

- Blog

- News

- Uncategorized

Australia’s property market is tightening – and fast. Low housing stock and rising property prices are creating a more competitive environment for buyers, while at the same time opening up unexpected opportunities for existing homeowners. Recent data highlights just how quickly conditions are shifting. According to Cotality, Australia’s median property price rose 1.0% in November…

The start of a new year often brings fresh goals, new plans, and big decisions. For many Australians, that includes thinking about buying a new home, upgrading, or reviewing their home loan to make sure it still fits their lifestyle and financial goals. Whether you’re planning a move or simply want your money working harder…

A record number of Australians are switching lenders – and the trend shows no signs of slowing down. According to the latest ABS data, external refinances in the September quarter jumped 25.2% compared to last year, reaching an all-time high. This surge isn’t being driven by restless borrowers or market noise. It’s happening because the…

With property prices continuing to climb across Australia, many buyers are turning to new builds as a more affordable and flexible alternative to purchasing existing homes. According to recent data from the Housing Industry Association (HIA), new home sales surged by 25.9% in September, with a 4.0% increase over the quarter – a clear sign…

At CoastFin, we’re always keeping an eye on the trends that affect our clients across the Central Coast. And right now, there’s some good news: fewer Australians are falling behind on their mortgage repayments. According to the latest data from APRA (the Australian Prudential Regulation Authority), the number of home loans running 30–89 days late…

Spring has arrived – and with it, renewed energy in the Central Coast property market. As flowers bloom and days grow longer, buyer confidence is also blossoming thanks to interest rate cuts, infrastructure upgrades, and a steady stream of new listings. Whether you’re a first-home buyer, investor, or planning a sea change, CoastFin is here to help…

The federal government has released 50,000 new places under the Home Guarantee Scheme for the 2025-26 financial year, giving more Australians the chance to enter the property market sooner. The scheme is designed to support those who often face the biggest challenges breaking into the market – including first home buyers, single parents and…

Trends, Hotspots & Local Insights for First-Home Buyers and Investors Thinking about buying property on the Central Coast in 2025? Whether you’re a first-home buyer ready to step into the market or an investor looking to expand your portfolio, the Coast offers plenty of opportunity – but also some unique considerations. As local mortgage brokers…

Refinancing your home loan can be a smart financial move, especially in a dynamic market. Whether you’re looking to reduce your monthly repayments, access better loan features, or tap into your home’s equity, refinancing can offer several advantages. However, it’s essential to weigh the benefits against the considerations to ensure it’s the right decision for…

As a business owner, managing your finances effectively is crucial for growth and sustainability. One powerful tool at your disposal is asset finance. At CoastFin, we offer tailored finance solutions to help companies like yours thrive. Here’s why asset finance can be a game-changer for your business: 1. Preserve Cash Flow Asset finance allows you to…

Five years on from the start of the covid-19 pandemic, the property market is in a very different place. When the pandemic started, some banks predicted a crash in property prices. Instead, the national median price fell just 1.7%, before rebounding. By March 2025, the national median was 38.4% higher than in March 2020,…

The Reserve Bank of Australia (RBA) announced a reduction in the cash rate from 4.35% to 4.10%. This marks the first rate cut since 2020! The move was widely anticipated, as annual inflation dropped from 3.6% in the September 2024 quarter to 3.2% in December, bringing it closer to the RBA’s target range of 2-3%.…

A key advantage in owning your own home is seeing its value increase – up an average of 21 per cent nationally last year. That increased value can be unlocked by using the equity in your mortgage to finance such things as a granny flat, create a home office, or install a new kitchen or…

The vast majority of home loan customers are currently choosing variable-rate loans over fixed-rate loans. In August 2024, 98% of new loans were variable, while 2% were fixed, according to the most recent data from the Australian Bureau of Statistics. By comparison, in August 2021, when interest rates were at record-low levels, 46%…

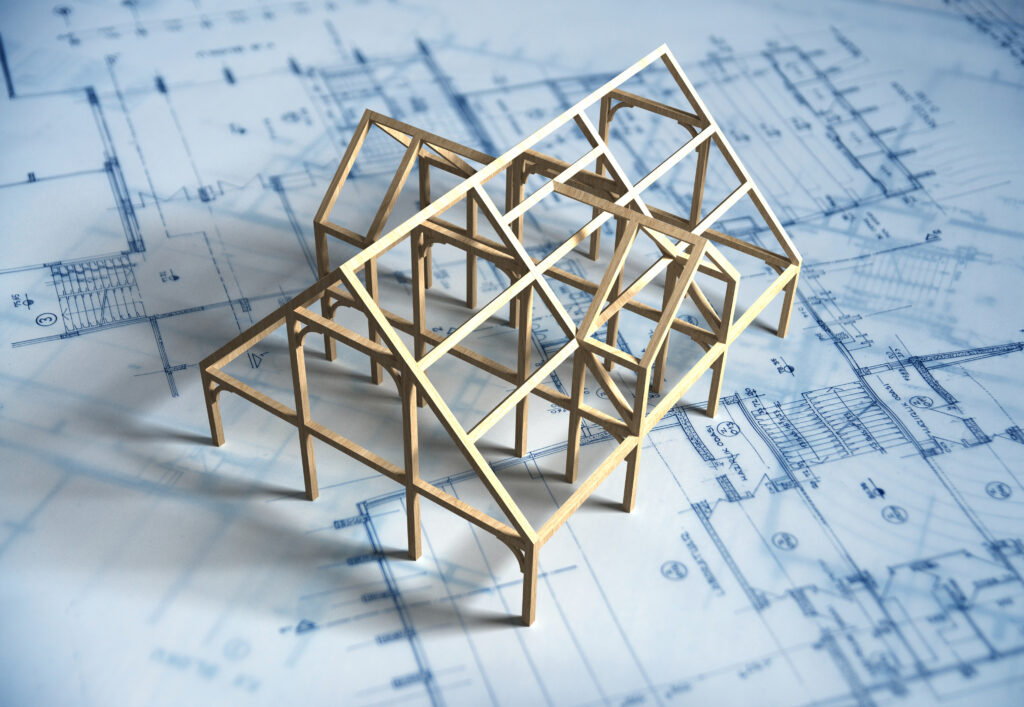

One of the great things about constructing your own home is that it can be tailored to your specifications. If you’re interested in building rather than buying your dream home, here’s the process you need to follow: Speak to your broker about your goals, so you can create a finance plan together Buy the land…

Home hunters have considerably more stock to choose from than earlier in the year, putting buyers in a stronger negotiating position. SQM Research has reported that the total number of listings across Australia in August was 7.9% higher than the month before and 11.1% higher than the year before, while the number of new…

Property investors have enjoyed a golden run over the past five years, during which the national median rent increased 39.7%. However, in July, rents increased just 0.1%, which was the slowest growth since 2020, according to CoreLogic. At the same time, annual rental growth has been trending down over the past few months. Between February…

Why use a Mortgage Broker? When you are planning to buy a house, there are so many things to consider. One of the biggest impacts after finding the that perfect home is the costs and funding options to actually purchasing it. There has been an historical trend for aspiring home buyers to go directly to…

Are you seeking a mortgage loan, mortgage broker, or mortgage lender in Erina? Whether you’re seeking a forever home or investment property (or both), you’ve come to the right place. CoastFin lives, eats, sleeps, and breathes home loans. The mortgage process is rife with challenges–but these challenges can all be overcome by following the correct…