Australia’s property market is tightening – and fast. Low housing stock and rising property prices are creating a more competitive environment for buyers, while at the same time opening up unexpected opportunities for existing homeowners.

Recent data highlights just how quickly conditions are shifting.

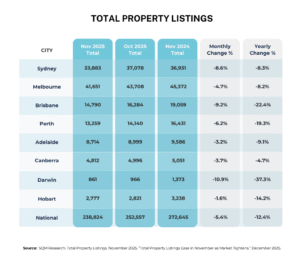

According to Cotality, Australia’s median property price rose 1.0% in November 2025 and 3.1% over the quarter. At the same time, SQM Research reports total listings fell 5.4% month-on-month, with new listings dropping a sharp 11.3%. Fewer properties are coming to market, and buyers are having to compete harder for what’s available.

So what does this mean for you – whether you’re buying, already own a home, or planning your next move?

What Low Stock and Rising Prices Mean for Buyers

With fewer homes on the market, buyers are facing a tougher, faster-moving market. Properties are selling more quickly, and competition is increasing in many areas.

If you’re buying, here’s how to stay ahead:

Expect More Competition

Low stock levels mean fewer choices and more buyers chasing the same properties. In-demand homes can attract multiple offers, often within days of listing.

Pre-Approval Is a Major Advantage

In a competitive market, finance pre-approval can be the difference between winning and missing out. Sellers are more likely to favour buyers who can move quickly and confidently, without delays.

Clarity Helps You Avoid Overpaying

Knowing your budget, limits, and non-negotiables before you start house-hunting is crucial. Clear borrowing capacity helps you bid with confidence and avoid stretching yourself financially in the heat of competition.

The Unexpected Upside for Homeowners

While buyers may feel the pressure, rising prices and low stock can work in favour of existing homeowners.

Your Equity May Have Grown

With property values climbing, many homeowners are sitting on more equity than they realise. Even modest price increases can significantly improve your borrowing position.

Equity Can Unlock New Options

Increased equity may allow you to:

- Refinance for a better rate

- Renovate or upgrade your current home

- Upsize or invest sooner than expected

A Simple Equity Check Helps You Plan Ahead

Understanding how much equity you’ve gained gives you clarity and control. It can help you plan strategically for the year ahead – whether that’s consolidating debt, improving cash flow, or preparing for your next property move.

Navigating a Tight Market with the Right Advice

Low stock and rising prices are reshaping the property landscape. For buyers, preparation and speed are essential. For homeowners, the current market may be creating opportunities that weren’t there just months ago.

If you’d like to check your borrowing position, assess your equity, or explore what options are available, contact one of our CoastFin Brokers to run the numbers and guide you through your next steps with confidence.